First of all, welcome! And congratulations that you have dared to enter this area of the not-so-distant future.

The Web3 world sees thousands of new users on a daily basis. This article aims to provide a solid foundation to accompany anyone on the first attempts in the decentralized crypto space. This guide will help you understand what Web3 is and how you can enter the space as a rookie.

Before we start, please note that nothing in this article can be considered financial advice. We only mention all of the tokens, currencies, platforms, and trading methods in this article to give you real-life examples and a place to start. Always remember the dot-com bubble: The majority of all the cryptocurrencies and NFTs are likely going to be worthless. Don’t bet the farm 🐮

*Spoiler: If you want to learn more on the dangers and scams of crypto and web3, just wait a little*

Basic definitions

Since all of this (NFTs, crypto, and Web3) is new to most people, we want to start our common crypto journey with an article packed with definitions and resources. This way, we want to make sure that we are thinking about the same thing when talking about blockchain, tokens, exchanges, nfts, etc., in the future.

Blockchains:

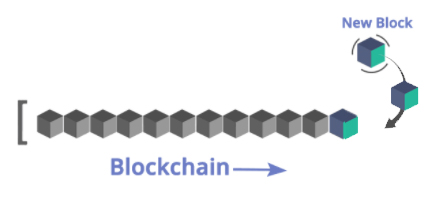

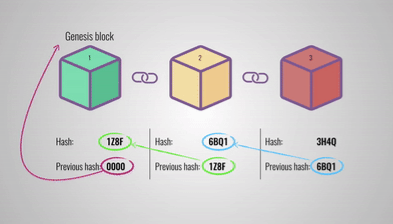

A blockchain is a decentralized public ledger that records the state of any type of information. This can be money transactions, but also any other forms of information that change their state over time.

Source: Edureka

Source: Edureka

A blockchain is maintained across several computers that are linked in an open, peer-to-peer network, which anyone can join. This also means that anyone can write (and read) information on the blockchain.

To make sure new recorded information is correct and not corrupted, and older entries are not changed or manipulated, a consensus mechanism makes it very expensive to cheat. Currently, the most commonly used consensus mechanisms are Proof-of-Work and Proof-of-Stake. This whole process is usually simply called “securing the network”.

Source: Simply Explained

Source: Simply Explained

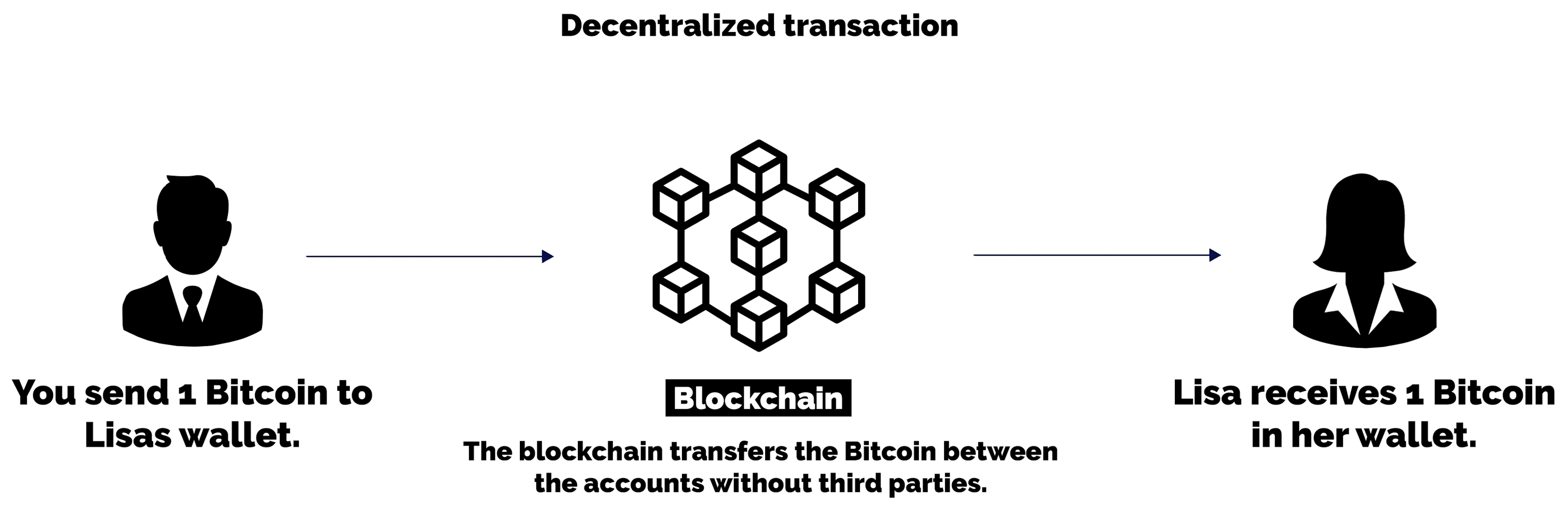

The game-changer is that no central authority is needed to ensure that the recorded information is valid. Ergo no bank needs to confirm and vouch that you indeed sent money to your friend.

Centralization:

If you have heard about Bitcoin or Ethereum, you surely came across the term “decentralization”. The concept itself is not that complicated, but it is by no means easy to grasp decentralization in all its complexity. So before we explain decentralization, let’s first set the record straight on what centralization is.

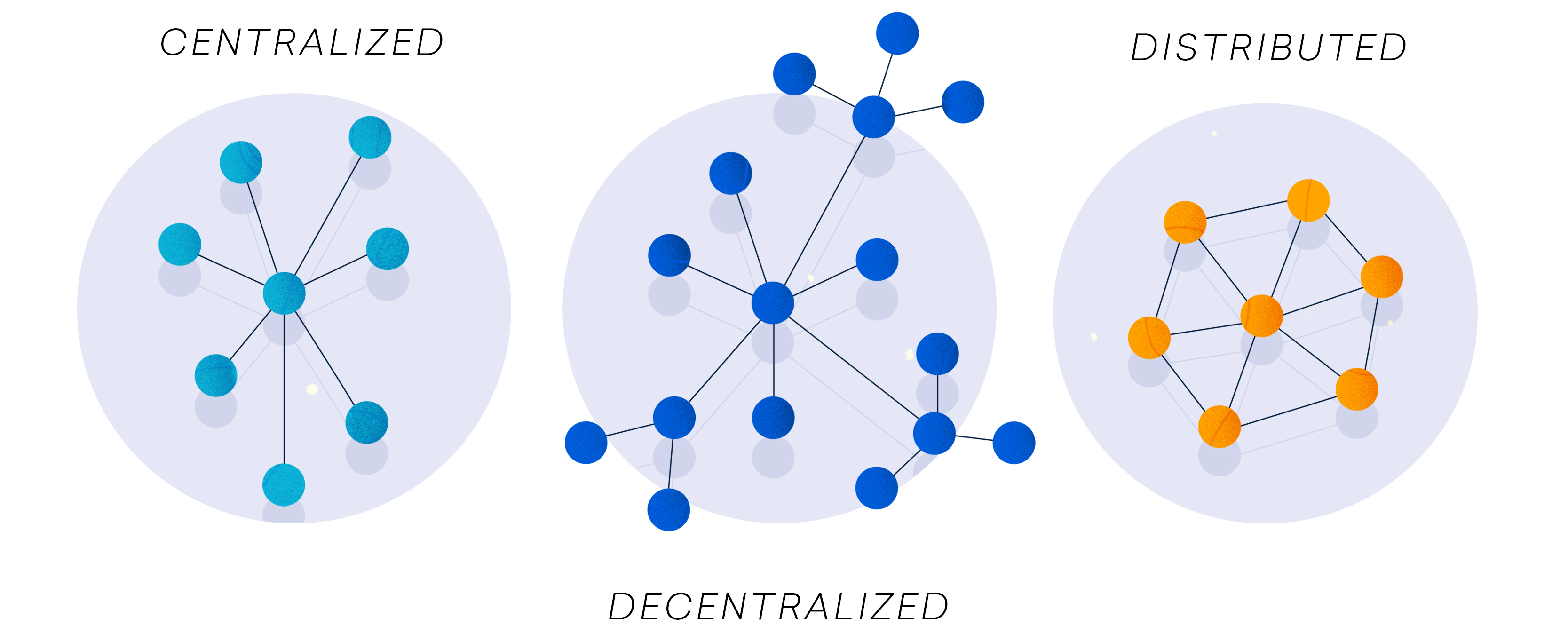

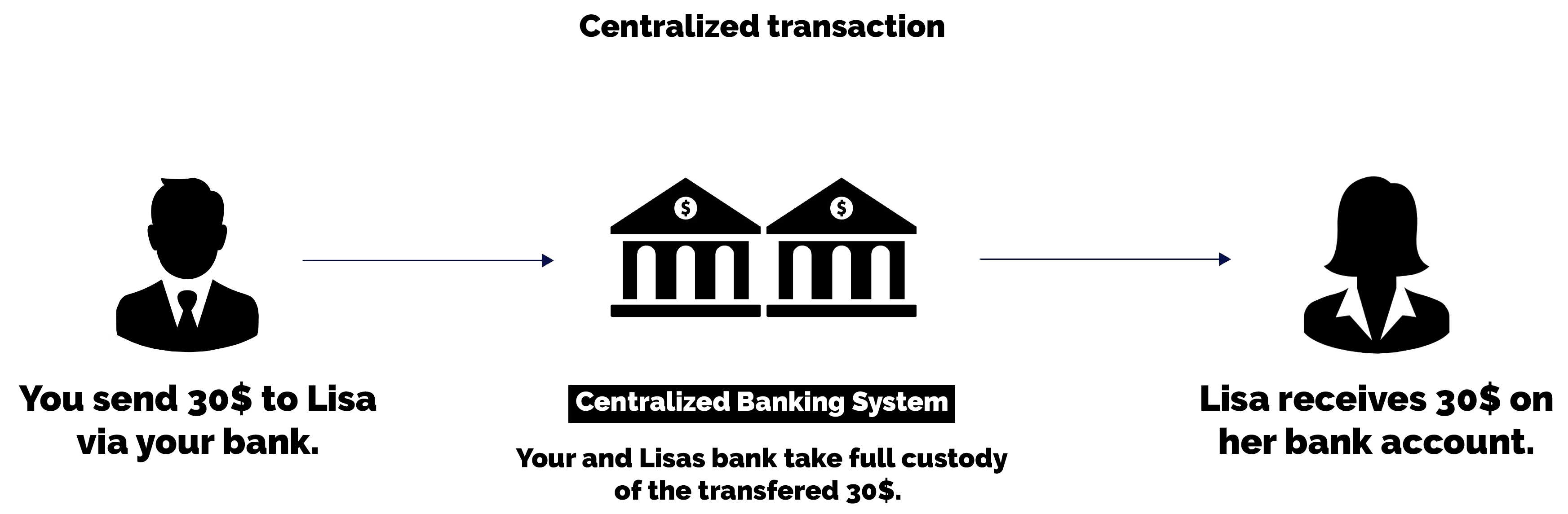

Generally speaking, centralization refers to an organizational structure in which one central entity has the authority to make decisions. Furthermore, such centralized systems tend to be less open and accessible, making access to relevant information a privilege.

Let’s pick Social Media platforms for an example. Your data (e.g., all your pictures, messages, etc.) are saved on centralized servers owned solely by the platform providers. They control the access to that information, meaning that if they would use your data for something you disapprove, you would never know 🥸 .

The same is also true for banks and our current monetary system. It is a centralized system in which a small portion of institutions makes the decisions.

If the bank thinks they need to block this transaction, they are free to do so. And there is nothing you can do.

Decentralization

On the other hand, decentralization is the process by which the activities of an organization, particularly those regarding planning and decision making, are distributed or delegated away from a central, authoritative location or group (Wikipedia definition).

Decentralized systems tend to have more open access to information, and most importantly, are not dependant on one entity. This is crucial when bad actors start climbing in power as they will never control a whole system by controlling only one entity. In the same logic, a decentralized structure is harder to take down, as there is no single point of failure.

The disadvantage of a decentralized structure is that it is much more difficult to coordinate things and reach a consensus. It also means that responsibility is distributed to each one individually.

For example: Did you send 10 Bitcoin to the wrong address? Bye bye money.

If you decide to send your friend money directly, you are free to do so. The network is only executing your order.

Permissionless-ness

Before applying the principles of decentralization to cryptocurrencies, we need to look at one more thing: permissionless-ness.

Cryptocurrencies are permissionless. This means that no one needs to permit you to use them. This concept is very strongly tied together with the ideology of decentralized systems in that no one authority has the power over the system. This also means that no one authority should have the power to decide who can and who can not use the system. In return, anyone should be able to use them.

So in summary, the more decentralized a cryptocurrency is, the harder it is to take them down, and the more likely it is that literally, anyone can use them.

On the other hand, the more decentralized a cryptocurrency, the harder it is to apply changes to the network.

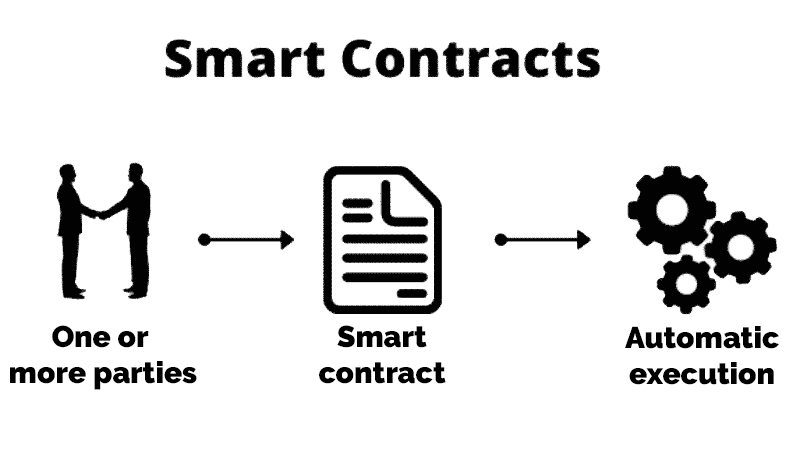

Smart Contracts:

Smart Contracts are the technology that enables Web3. While a detailed explanation of how they work would be out of scope for this article, you should remember that through smart contracts, blockchains can compute complex automated actions. These actions are then written to the blockchain: they can no longer be reverted once written.

Smart contracts are automated actions (if A, then B) that cannot be changed once added to a blockchain. This makes them extremely trustworthy and without the need of a third party to certify everything.

The most important protocol that uses Smart Contracts is the Ethereum network and its resulting Ether cryptocurrency. You can think of Ethereum as a giant computer network, similar to the Internet, but with an integrated currency (Ether -> ETH).

Web3:

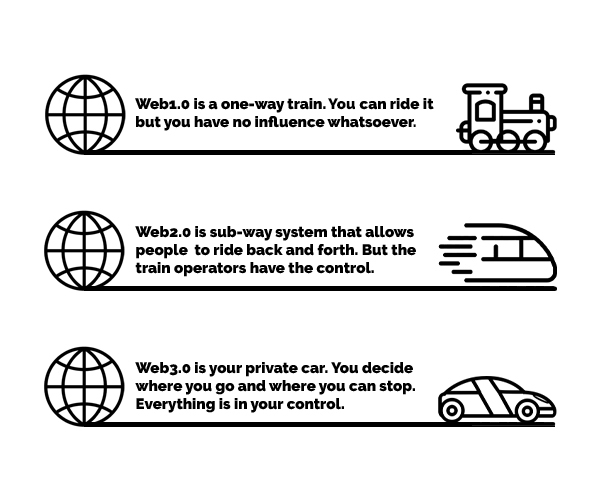

Web3 is a term that is popping up everywhere these days. Everybody seems to have some conception in his mind, but nobody can give a solid definition, which makes sense if you think about it. How could we define an idea that just started to develop? Did we know what Web 2.0 would be in the early Web 1.0 days? No. So giving you a concrete and satisfying answer to “What actually is Web3” is not that easy yet.

In short, the Web3 is the next phase of the Internet that directly integrates blockchain technology and thus allows the Internet to have its own native economy. In Web3, content creators will be able to own their digital content directly and use internet-native currencies to trade with each other openly.

For further reading, this Web3 related article on Medium summarizes the topic in a simplified way:

Or if you prefer video, the one below is also a nice reminder about where we (the Internet) are coming from and what has changed over the years.

Web3 Wallet:

Through specific interfaces commonly called “wallets,” the Internet and blockchains like Ethereum are directly connected. These wallets are either plugins or add-ons that you can add to your favorite internet browser or stand-alone apps that you can install directly on your phone.

To interact with the Web3 and so-called decentralized apps (dApps), you will need such a wallet.

For beginners, we recommend Metamask.

Cryptocurrencies:

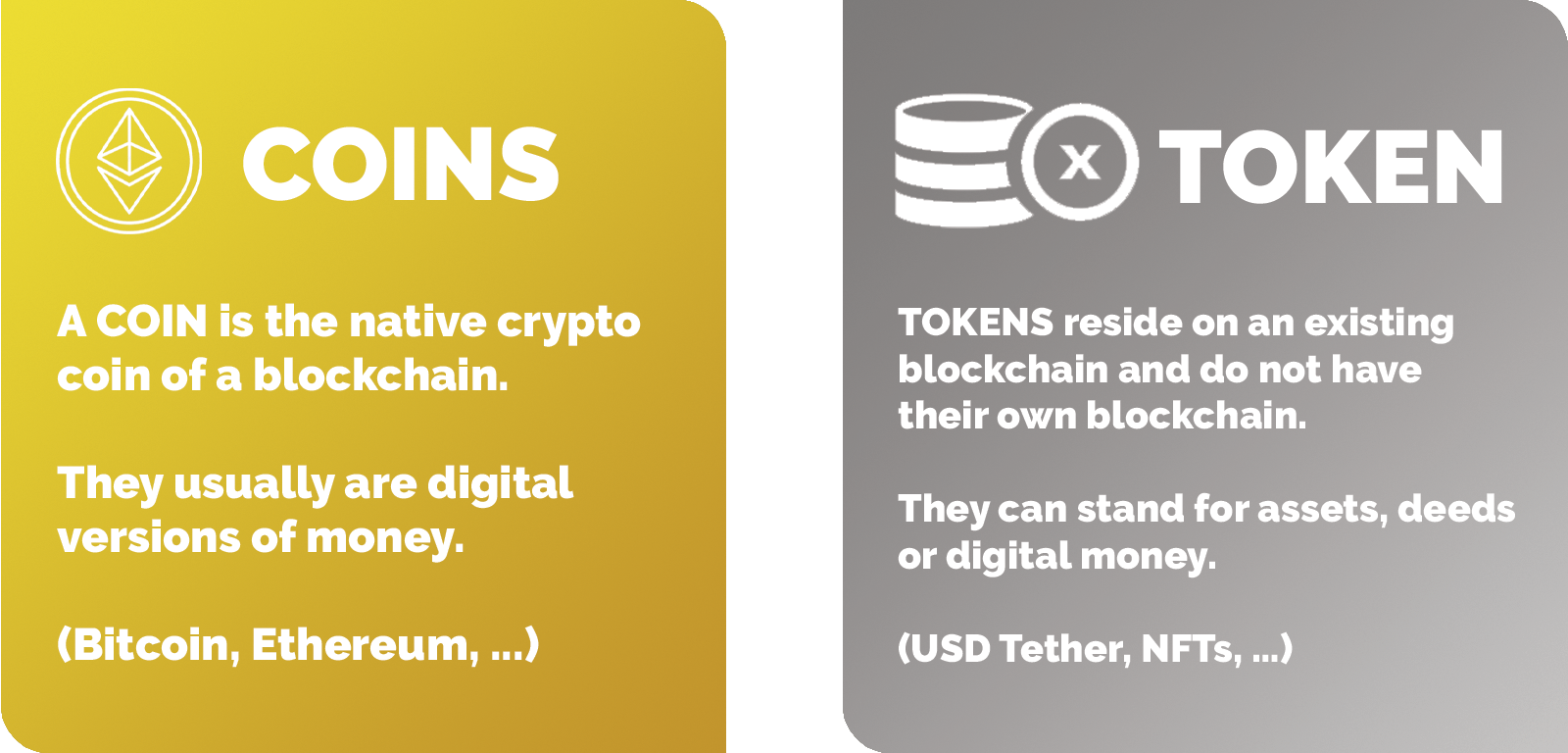

A cryptocurrency is a reward that a computer receives for securing a blockchain.

Popular examples of cryptocurrencies are Bitcoin, Litecoin, Ether, Binance Coin, or Dogecoin.

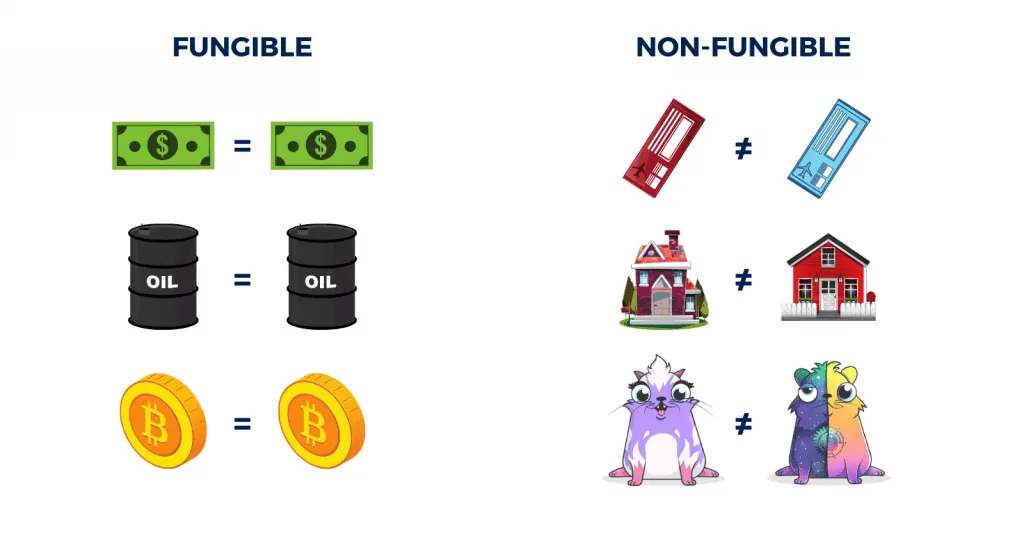

Cryptocurrencies are fungible, meaning that you can freely interchange them, like Euros or Dollars.

In terms of terminology, there are small differences between what is generally understood as Coin and Token.

NFT definition:

“A Non-fungible token is a unit of data stored in a smart contract on a blockchain.” Wow… 😅

When we break this down, we see that an NFT has these 3 criteria:

– Unit of Data (TokenID)

– Smart contract

– Stored on a blockchain

In practice, these data units certify that digital ‘things’ are unique and therefore not interchangeable. Thus, NFTs can represent assets or deeds, for example. Today, NFTs are most popular because they can make digital files (like images or videos) unique and thus allow artists to sell them as scarce & tradeable assets.

Note that the NFT smart contract and its related so-called TokenID only act as proof of ownership, but they do not represent the actual asset. What this actual asset is, is usually defined in the so-called TokenURI of the smart contract.

Difference fungible <-> non-fungible:

Fungible: “1 Bitcoin is the same as another Bitcoin and has the same worth.”

Non-Fungible: “1 NFT of artist Beeple is not the same as an NFT of artist FVCKRENDER and can be worth more/less.”

Exchanges:

Exchanges are platforms that let you buy, sell or change (swap) your tokens for other tokens or FIAT currencies like Euro or Dollar (similar to a currency exchange counter at the airport).

Note that there are two types of exchange platforms: centralized and decentralized.

Centralized exchanges are basically recognized by the fact that you can deposit and/or withdraw FIAT currencies. They act more or less like a modern bank, where you have to register and identify yourself as a customer. You can then trade and exchange money from your bank account for cryptocurrencies like Ether or Bitcoin.

Decentralized exchanges typically only offer the exchange of crypto coins or NFTs. Therefore, they do not require real-life identification, and you can use them anonymously with your Web3 Wallets. However, note that every transaction gets a record on the blockchain and is thus public by design.

Where do you start

After listing and explaining the basic terms and concepts that you need to know, we want to dive a little deeper into the maybe most important piece of the puzzle in your early crypto career – your wallet.

The wallet

To engage in any blockchain and web3 activity, you must set up and use your own wallet. For beginners, the term WALLET is often misleading as it is not only a place to store your tokens. Instead, it is your connection to a blockchain – like an account to access all the features.

As always, there are centralized and decentralized wallets. Centralized wallets are usually bound to exchange platforms such as Binance or Bitpanda. They have regular logins, and you can access them through passwords and 2FA (two-factor authentication).

On the other side, you also have decentralized wallets such as MetaMask, Keplr, Phantom, and so on.

Once you create your decentralized wallet, you will receive two things:

– a Public-Private Keypair

– a Seed phrase or secret recovery phrase

Important safety instructions

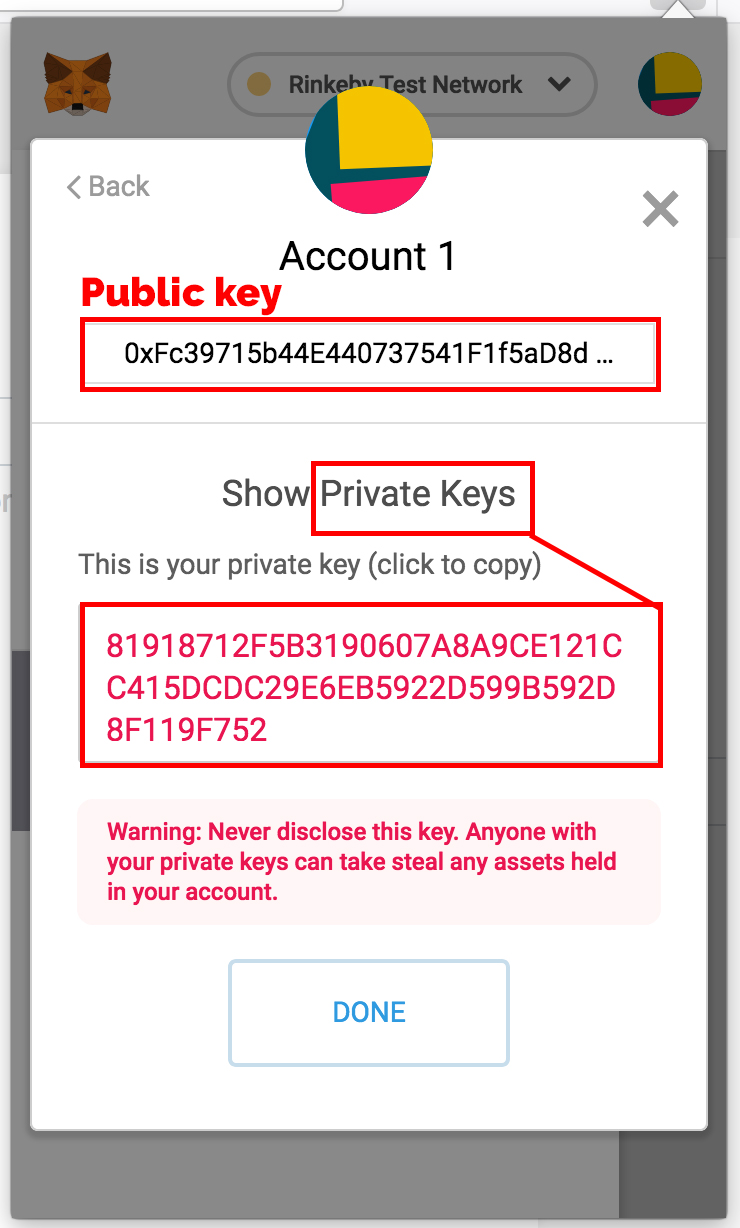

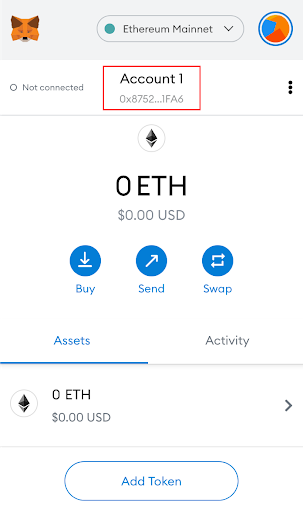

Your public key is the address you will use to identify and share your wallet.

Your private key and the secret recovery phrase are your personal secrets that you can use to recover your account in the future.

You can think of your public key as your house, and the private key is the key that unlocks the front door.

If you lose your seed phrase or private key, everything in your wallet will be inaccessible forever! It is impossible to generate the private key by knowing only the public key (If you didn’t know: that’s how cryptography generally works and why encryption is secure).

So remember: you will only ever share the public key, but never the private key.

On Metamask, you will be able to find and copy the public key right here:

Public key on MetaMask

Useful links and resources

First, we would like to mention our own web3 and blockchain resource library here. You’ll find helpful tools, guides, and videos about web3/blockchains/DeFi (decentralized finance) in this library. Once you are familiar with all the topics and contents from our resource page, you have a big head start compared to most people out there.

If you want to dive in right away, though, we gathered some essential links for you to round up this article 👇

Exchanges and trading platforms to start:

Centralized: Binance | Bitpanda | Coinbase | FTX

Decentralized: Uniswap | Sushiswap | dYdX

NFT marketplaces:

FIAT buy: Niftygateway

Crypto buy: Opensea | Rarible | Niftys

Crypto tutorials & guides:

WhiteBoard Crypto (crypto in general) | Dapp University (blockchain development)

That’s it for part 1 of our web3 guide. Hopefully, we gave you a good first idea of what you should focus on right now so that wagmi (we all gonna make it).