The world of NFTs is full of exciting projects, beautiful art, and active communities. On the other side, you have scammers, “rug pulls,” and meaningless JPEGS that were created to make quick money off you.

Here are a few tips and tricks that should help you to avoid scams in this very new industry.

Keep in mind that “Non-Fungible Tokens” can have many use-cases, but right now, they’re mostly being (ab)used for marketing purposes. NFTs can represent art pieces, access-tokens or membership cards for communities and content, debt obligations, and so on. This article will mainly focus on the buying and selling of art and community-related NFTs. We hope that you can learn how to avoid common mistakes and expensive errors as a collector and trader with these beginner tips. If you are new to crypto, Web3, and NFTs, you might want to start your journey here: Web3 Guide.

@goneon.lu How to explain #NFTs to your parents 👀#fyp #Web3 ♬ Originalton – neon marketing technology

1) No financial advice

As for every NFT, crypto, and Web3 blog post: No information in this article is any kind of financial advice. Instead, we want to give you a basis and push you to DYOR (do your own research) to learn what all of this is about.

It is essential for you to understand this: NFT art pieces are highly volatile assets that can either “pump to the moon” (price goes up) or dump into the abyss (price goes down) within days or even minutes. Unfortunately, for beginners, it is often hard to understand what is happening in the markets until it is too late. So always remember: If there is no buyer for your NFTs, there can be no seller.

Furthermore, it is important to note that buying and selling cryptocurrencies or NFTs are taxable events in many countries.

Please note that everything we state in this article today can be outdated and wrong tomorrow, even though it has been true for months.

2) Risks of collecting and investing

There are a variety of reasons to buy NFTs. The selection criteria for each motive differ heavily and might even be opposing. So it is impossible for us to tell you what you should or shouldn’t buy. But we can try to lay out the different mindsets with which you can approach buying your first NFT.

buying the utility

Whenever you buy a specific NFT because you’re interested in the actual utility behind it, the current and future prices are relative. If you’re okay with the fact that the actual NFT could theoretically be worthless tomorrow, then nothing is stopping you from buying it. In this case, you can often consider the NFT like a coupon code that you trade in exchange for something you want in the future.

For example: Do you want the physical items that you will get by holding Adidas’ first NFT? Go for it if you are willing to pay the price. Since you are not buying a nice TV because it will be worth more next year either, do you?

investing in artists

The NFT space is so young and packed with new or upcoming artists that create extraordinary content or offer exclusive community benefits through their NFTs. Thus investing in artists or their collections can be a reason to buy NFTs too.

In contrast to the first point, the prospect of profit at some point in the distant future is now already resonating a little. Investing in an artist is similar to investing in an idea or a start-up. You like the concept and bet that more people will feel the same way in the future. Which will increase the price of the content as demand is increasing.

Nowadays artists like Beeple, Pak, or Fvckrender might come to mind. A big part of the active NFT community agrees that the creations of these artists have a certain worth and are not solely based on a short-term hype. BUT this is by no means a guarantee, that those artists are a safe or good investment in the future!

In general, our advice here is to invest in artists who are dedicated to the crypto space and that create innovative concepts using the medium of NFTs. On the other hand, investing in an NFT that “only” gives ownership rights to a digital image is usually a bad idea, especially if the artist does not have a respectable following yet.

flipping NFTs for profit

“Flipping,” like trading, is a term that describes the approach of buying NFTs at a low price and selling them quickly for a profit. So you don’t buy the pieces to keep them in your collection but instead sell them as soon as they bring you measurable profit (up to you whatever that amount is, but never forget about potential Gas fees that you need to pay on all your transactions).

You can call “buying NFTs for a low price and selling them later for a higher price” trading, but to be completely honest with you, often it seems more like gambling. So be careful not to invest more money than you can afford to lose. Also know, that you are competing with trading bots, which are usually much more intelligent and faster than you are.

One piece of advice is that you want to look out for new collections that have not been hyped too much yet. Otherwise, you might already be too late and end up buying the top, meaning that you become exit liquidity for people that are ready to take profits and leave the NFT project.

Successful flipping is not a beginner move. Of course, everybody can be lucky when the market is euphoric. But more often than not, you will be left with very small to no profit at all. Especially if you start with small investments. Transaction fees, royalties, and every other kind of fee very quickly diminish your potential gains and sometimes even leave you with a loss (even though your trade was profitable on paper).

3) NFT criteria to look out for

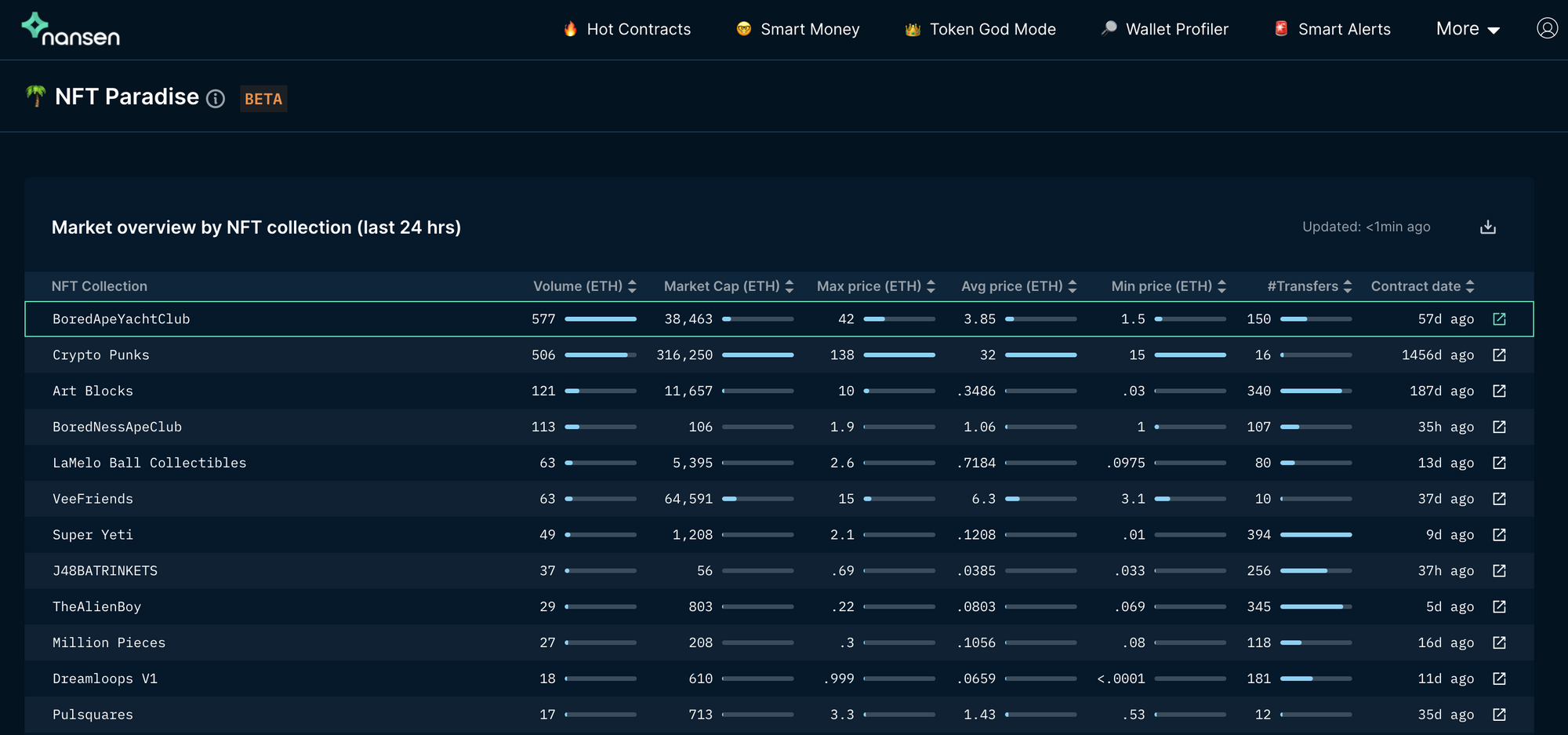

It is almost impossible to safely tell if a project can generate a quick profit or is worth getting in the long run without insider knowledge. Nevertheless, we want to give you some basic criteria that you have to look out for when you come across a new project that gets your interest. And if those stats look bad, to begin with, it is safer to stay away as a beginner.

Basic data:

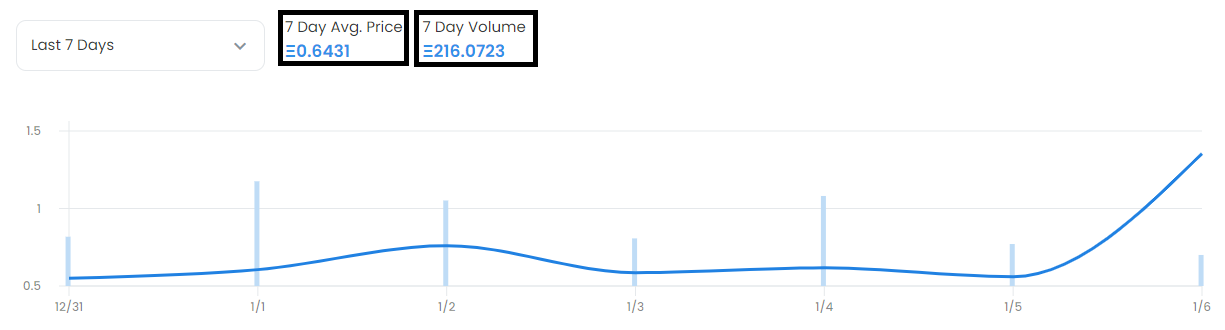

How old is the collection? Is there a hype around it slowly building up, or is it over already? Is the artist well-known in the space? How did the price evolve over the past hours or days?

Try to get a feeling for what is going on and compare it to other collections. Look out for recognizable price patterns, and when in doubt, DON’T TOUCH IT.

Scarcity:

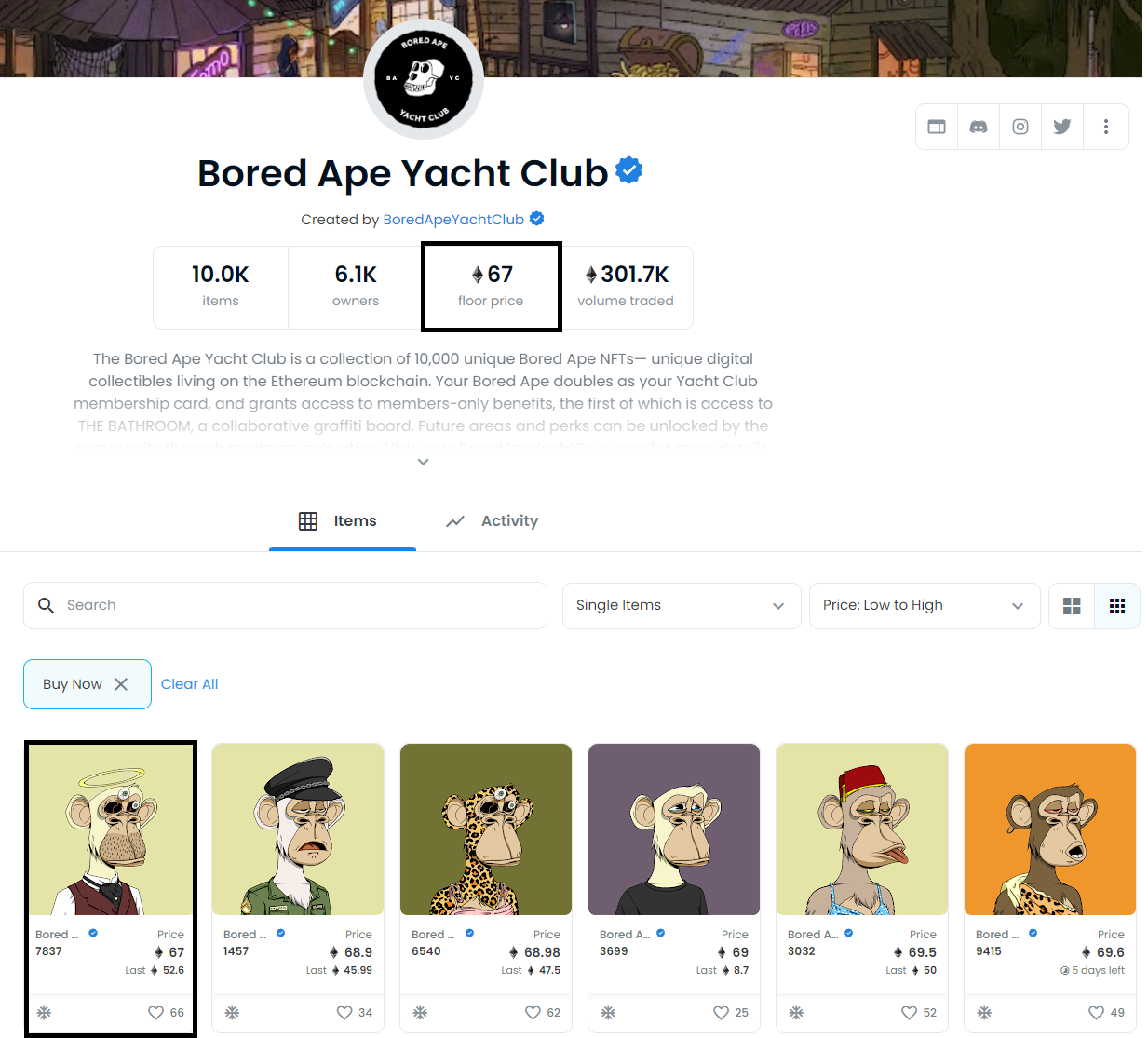

How many items were minted (created) for this project? Is it a collection of 10.000 NFTs or only 1500? More items often lead to less extreme short-term price movements – BUT NOT NECESSARILY. Even large drops can create massive price swings if the demand is big enough.

Low floor price:

The floor price of an NFT-collection tells you the price for which you can buy the cheapest piece of said collection. The cheapest NFT of the collection usually gets bought first. So realistically, you want to buy your NFT at a cheap floor price and sell once the floor price is higher. The higher the initial cost, the smaller the chances of doubling or tripling your investment – generally speaking.

For example, a few weeks ago, the “Bored Ape Yacht Club” floor price was at 67 ETH. Today it is at over 100 ETH.

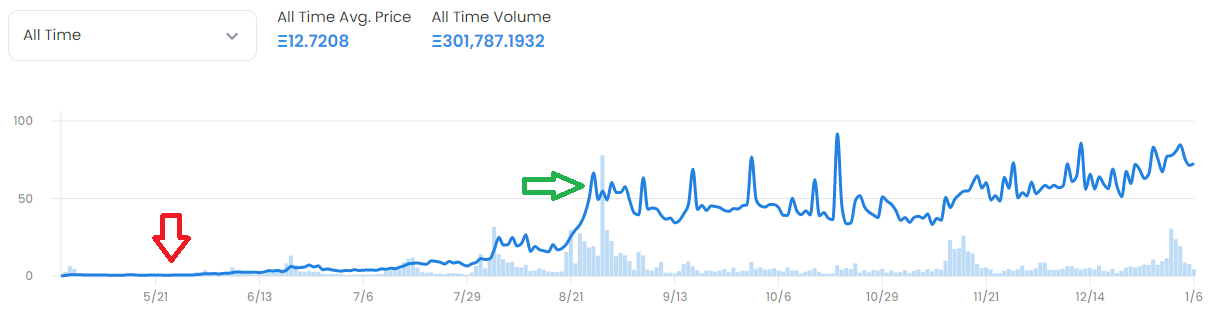

Trading volume:

The Trading volume tells you whether people are actively selling and buying this collection. It is an aggregation of all purchases and sales the collection created. If collections are not creating any interest and if people are not actively trading them, short-term gains will be hard to come by.

Social media shilling:

Once “so-called” Influencers shill (promote) a project on their Social Media feeds or blogposts, flipping the NFTs for profit becomes harder. Usually, they bought the NFTs very early and are now driving the price up to sell for a profit themselves. On the other side, many people talking about a project can be a good thing too. Many significant collections kept rising in price for months now. But the risk of losing money with short-term flips becomes bigger.

4) Conclusion

Finding new projects is hard work

Digging through the depths of CryptoTwitter and the infinity of Discord servers to find promising projects can be a full-time job. No one can tell you which NFTs you should buy. Doing so is almost always irresponsible. This is why we again want to emphasize that everything mentioned in this article is for education and research purposes only.

Alternatively, you can use paid tools like Nansen.ai, Dune.xyz or even Etherscan.io to find projects as soon as they have been minted. But to do this successfully, you need experience in analyzing and understanding the market. Searching online articles and traditional media outlets for your next buy is probably not the best idea – in our opinion. They often hint at various marketplaces’ “top artists” and “top collections” sections. And while it might be true that featured projects are famous and get traded a lot, they often have reached a relatively high price tag. If you want to buy and keep the NFT, this might be fine though.

NFT art is a new culture

The whole NFT and crypto space is a new culture that you have to embrace and interact with in order to understand it. One does not learn about culture by reading about it but by being involved, invested, and becoming part of the whole experience. So while we can’t tell you what you should invest in, we recommend you to get “skin in the game” and push your NFT knowledge. After all this new technology is here to stay and will define the digital world in the years to come.

@goneon.lu Are #NFTs here to stay? Let us know what you think in the comments! #fyp #nft ♬ Originalton – neon marketing technology